Tired of Accountants Who Only Show Up at Tax Time?

Start getting proactive financial advice, not just paperwork.

At Cadenze, we work alongside you all year round to improve structure, strategy and outcomes so you’re not just meeting tax deadlines, but building long-term wealth.

Experienced advice you can trust

We partner with family-run businesses to help you make smarter financial decisions, grow your wealth, and plan for the future with proactive, relationship-driven advice that goes beyond the numbers.

Worried You’re Overpaying Tax?

We help you take control of your finances, reduce overwhelm, and make confident decisions that protect your business, your family, and your future.

Proactive advice that goes beyond the numbers.

Integrated tax, business, and wealth strategy.

Support with trust structures, SMSFs, and investments.

Planning for business transitions, exits, and legacy.

Our Expertise

Tax & Accounting

Beyond compliance, we offer

clarity, strategy and confidence.

Our Expertise

Navigate complexity with ease.

Personal & business tax returns

Strategic tax planning

Expert advice year-round

Audit

Audits with experience, not rotation.

60+ years of combined audit experience

Same team every year

Personalised insights, not just reports

Virtual Management Accountant

Know your numbers, grow your business.

Monthly or quarterly reporting

Tailored insights and forecasting

Regular meetings to support decision-making

Corporate Secretarial Services

Stay compliant without the stress.

ASIC lodgements

Annual company statements

Company register maintenance

SMSF

Maximise retirement freedom.

SMSF compliance & admin

Tailored support across entities

Integration with your broader strategy

Business Consulting

Strategic advice that aligns

your personal and business goals.

Business

Build a future-ready business.

Budgeting & forecasting

Management reporting

Strategic reviews

Succession & Estate Planning

Protect your legacy.

Intergenerational planning

Entity structuring

Exit strategy guidance

Due Diligence

Buy and sell with confidence.

Acquisition support

Financial reviews

Risk identification

Virtual CFO

Your strategic finance partner.

High-level oversight

Decision support

Goal tracking

3 Steps to a Clearer

Financial Future

Most accountants just tick boxes.

We take the time to understand

your bigger picture and walk a

longside you every step of the way.

Succession & Estate Planning

We take the time to deeply understand your business, goals, and what keeps you up at night, so we can plan around what really matters.

Build a Plan That Works for You

No one-size-fits-all advice here. We design a clear, tailored financial strategy to help you move forward with confidence.

Stay Supported,

Always

With proactive check-ins, strategic reviews, and hands-on support—you’ll never feel forgotten again.

Ready for Advice That

Goes Beyond BAS and

Tax Returns?

Ready for Advice That Goes Beyond BAS and Tax Returns?

Not Just Numbers. Real People, Real Support.

According to CPA reports, the #1 complaint about accountants is poor communication. We built Cadenze to fix this.

Dear Business Owner,

We started Cadenze because we saw too many business owners being let down by passive, reactive accountants. People like you who are trying to grow a business, support a family and plan for the future, deserve more.

That’s exactly why we built Cadenze.

With us, you’re not just another file. You’re a partner. We build long-term, high-trust relationships and help our clients get proactive clarity across tax, structure and strategy.

We take the time to get to know your business properly, then create tailored strategies that integrate your business, personal wealth and legacy planning.

And we stick around.

Not just at tax time, but when decisions need to be made, when things change and when you need someone to call.

This isn’t about flashy financial buzzwords. It’s about clarity, consistency and care. That’s what our clients value most, and if that’s what you’ve been looking for, we’d love to chat.

Warmly, The Cadenze Team

Our Expertise

Still Got Questions?

We’ve answered the most common ones below.

Will I always work with the same team?

Yes. You’ll have a consistent team who understands your goals, business history and structure. No call centres, no rotating staff, just real people, invested in your success.

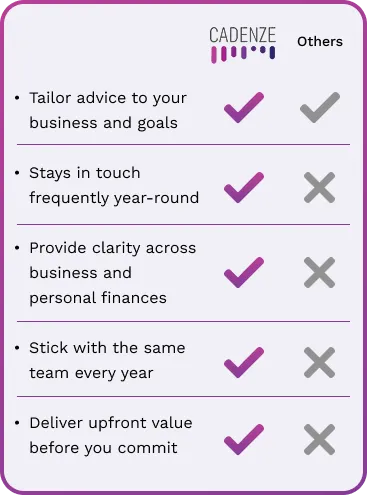

What makes Cadenze different from other accounting firms?

Most firms focus on compliance. We focus on clarity, strategy, and support. Our clients get proactive advice, regular check-ins, and a genuine partnership, not just tax returns.

Can you help if I already have an accountant?

Absolutely. Many of our clients come to us after feeling let down by previous firms. We’ll review your current setup and show you what’s being missed, without any obligation.

How do I know if I’m getting the most out of my current structure?

That’s exactly what our free financial diagnostic is for. We’ll assess your business and personal finances to identify tax efficiencies, restructuring opportunities, and gaps in your current setup.

What happens after I book the free diagnostic?

We’ll schedule a 1:1 session to understand your situation, identify quick wins, and outline your options. Whether you continue with us or not, you’ll walk away with valuable clarity.

Let’s Talk About Your

Business Future

Book a call with us and start getting the advice you actually need.